2.8m older households will still be living in fuel poverty this winter - despite the Government freezing the energy price cap

By: Age UK

Published on 20 September 2022 11:01 PM

1.3 million of whom are also living on lower incomes

Age UK calls for more targeted support for older people on lower incomes so they can get through the winter

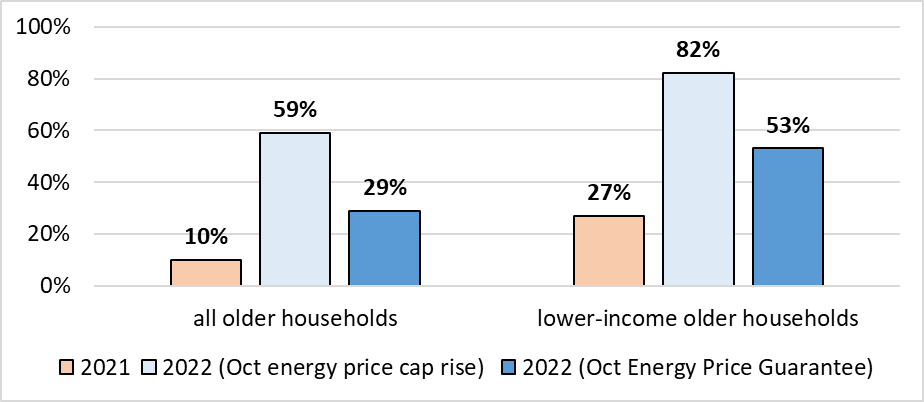

New Age UK analysis shows that from October 2022, around 2.8m (three in ten[i]) older households[ii] in England will be living in fuel poverty[iii], including 1.3m lower income older households. Even after the Government’s decision to freeze the energy price cap so that a typical household will pay £2500 per year for the next two years via its Energy price Guarantee (EPG), an additional 1.8m older households (including 620,000 on lower incomes) in England will be living in fuel poverty from October 2022, compared to one year earlier.

Ahead of the Government’s fiscal event, almost 35,000[iv] – the vast majority aged over sixty plus – have signed an Age UK letter to the Prime Minister, warning that the rapid rise in the cost of living is endangering older people’s lives. Polling (just before the EPG was announced) for the Charity also found that more than two thirds (67%)[v] of people aged 60+ in Britain are worried about being able to heat their home when they want to. Disabled people, those with long-term health conditions and people on lower incomes were more likely to be concerned.

Among lower income older households in England, half (53%) will be living in fuel poverty from October 2022 compared to a quarter (27%) a year earlier, and these will be people already living on very low incomes and/or in receipt of means-tested benefits. The lack of additional cost-of-living payments for Pension Credit and wider means tested benefits will mean that many will still struggle to heat and power their homes, despite the Energy Price Guarantee (EPG).

Chart 1: Proportion of older households in England experiencing fuel poverty, Age UK

From October 2022, the typical (median) older household in England will be spending the equivalent of seven pence[i] in every £1 of their after-tax household income on energy bills, and for the typical (median) lower income older household this figure will be 11 pence[ii] in every £1. Even after the Government’s decision to freeze the energy price cap older households (including those on lower incomes) in England will be spending around 1.5 times more of their after-tax household income on energy bills from October 2022, compared to one year earlier.

While the EPG means the maximum that energy companies can charge households per unit (kWh) of electricity and gas will be fixed for two years from October 2022, the unit rate is still almost double that of a year earlier. A typical household will pay an average of £2500 per year for their energy use and, with prices of other goods and services rising, there’s no doubt that many older households, especially the poorest, will find life very tough.

Without further Government support, targeted at those of all ages who need it the most, it is clear that significant numbers of people will be forced to make difficult decisions about whether to cut down on essentials such as food, or keep their home warm through colder periods. It’s no surprise that polling for Age UK has shown that 88% of people aged 60+ in Britain[iii] think the Government should keep the ‘triple lock’ – which is due to be reinstated from April 2023, but not yet confirmed by Government. If this happens it will give older people who depend on their State Pension to make ends meet a reason for hope through 2023.

A big concern for Age UK is the viability of care homes in the face of surging energy bills. Care homes face numerous challenges as we approach winter, and while we are pleased that they are in line for help from the Government’s business support fund, we worry that it may not be enough and, in any event, that it is so far only pledged for six months. We haven’t got enough care home places as it is so we can ill afford to see any care homes closing because they are made bankrupt by their energy bills.

The Charity is calling on the Government to give care homes ‘domestic status’ and to extend their support offer accordingly. As care homes will not be protected by the EPG, Age UK also recommends that care homes should be considered a ‘vulnerable industry’, hopefully entitling them to additional help after the six-month period of business support comes to an end.

Age UK is also concerned about the situation of charities, small ones especially, as they face huge hikes in their energy bills over the next few months. They should benefit from the Government’s business support package, but the Charity is worried this will not be enough to enable some of them to keep going.

Caroline Abrahams, Charity Director at Age UK: “Our new analysis shows that the Government’s relief package will not do enough to prevent approaching two million more pensioners from being plunged into fuel poverty in a couple of weeks’ time. Most worrying of all, in excess of half a million of them are already living on lower incomes, so they will be in an impossible position financially, unless the Government does more to help. However hard they try their income is not going to stretch far enough to cover the essentials any more. Can you imagine how terrifying this prospect is if you are an older person on a low fixed income who has just about managed so far? Once they realise what a deep financial hole they are about to be in our biggest concern is that some will cut their spending to such a degree that it puts them at risk.

“In total, we know that there will be 1.3 million older people on low incomes from October who will also be in fuel poverty, and the thought that this massive number of pensioners will be struggling and in many cases failing to make ends meet through the cold months is totally beyond the pale. Our analysis leaves no doubt that the Government must do more to help the poorest, or we will face a humanitarian emergency across the UK this winter like nothing we’ve seen in our lifetimes. The obvious solution is for the Government to raise the value of means-tested benefits like Pension Credit to reflect the scale of these extraordinary price rises, and that’s what we call on them to do.

“The Government must also ensure that care homes can manage their sky-high energy bills or we will see a further contraction of the battered care sector, with serious consequences both for older people and for hospitals struggling to manage soaring demand. And we have similar concerns for charities, especially small local ones, including our local Age UKs, among many others. It would be a tragedy if swathes of highly effective local voluntary organisations and community groups go under this year, purely because of their fuel bills and at a time when their local population really needs them.”

As part of its cost-of-living campaign, ‘It Doesn’t Add Up’, Age UK is urging any older person living on a low income or struggling with their bills to contact Age UK’s free Advice line on 0800 169 65 65 without delay to check they’re receiving all the financial support available to them. Alternatively, people can visit www.ageuk.org.uk/money or contact their local Age UK for further information and advice.

Age UK hosts a free and anonymous Benefits Calculator, available via www.ageuk.org.uk which can provide an estimate of the benefits that people could be entitled to.

To make a claim for Pension Credit, people should call the DWP Pension Credit claim line direct on 0800 99 1234 or visit www.gov.uk/pension-credit/how-to-claim. It can be claimed by phone and online.